However, expanding output from 4 to 5 would involve a marginal revenue of 400 and a marginal cost of 700, so that fifth unit would actually reduce profits. At an output of 4, marginal revenue is 600 and marginal cost is 600, so producing this unit still means overall profits are unchanged. If the marginal revenue exceeds the marginal cost, then the firm should produce the extra unit.įor example, at an output of 3 in this figure, marginal revenue is 800 and marginal cost is 400, so producing this unit will clearly add to overall profits. As the quantity sold becomes higher, the drop in price affects a greater quantity of sales, eventually causing a situation where more sales cause marginal revenue to be negative.Ī monopolist can determine its profit-maximizing price and quantity by analyzing the marginal revenue and marginal costs of producing an extra unit. When a monopolist increases sales by one unit, it gains some marginal revenue from selling that extra unit, but also loses some marginal revenue because every other unit must now be sold at a lower price. But a monopolist can sell a larger quantity and see a decline in total revenue. It may seem counterintuitive that marginal revenue could ever be zero or negative: after all, does an increase in quantity sold not always mean more revenue? For a perfect competitor, each additional unit sold brought a positive marginal revenue, because marginal revenue was equal to the given market price.

Notice that marginal revenue is zero at a quantity of 7, and turns negative at quantities higher than 7. The second four columns of this table use the total revenue information from the previous exhibit and calculate marginal revenue. This monopoly faces a typical upward-sloping marginal cost curve, as shown in this figure. The first four columns of this table use the numbers on total cost from the HealthPill example in the previous exhibit and calculate marginal cost and average cost. A monopolist can use information on marginal revenue and marginal cost to seek out the profit-maximizing combination of quantity and price. But a monopolist often has fairly reliable information about how changing output by small or moderate amounts will affect its marginal revenues and marginal costs, because it has had experience with such changes over time and because modest changes are easier to extrapolate from current experience. In the real world, a monopolist often does not have enough information to analyze its entire total revenues or total costs curves after all, the firm does not know exactly what would happen if it were to alter production dramatically.

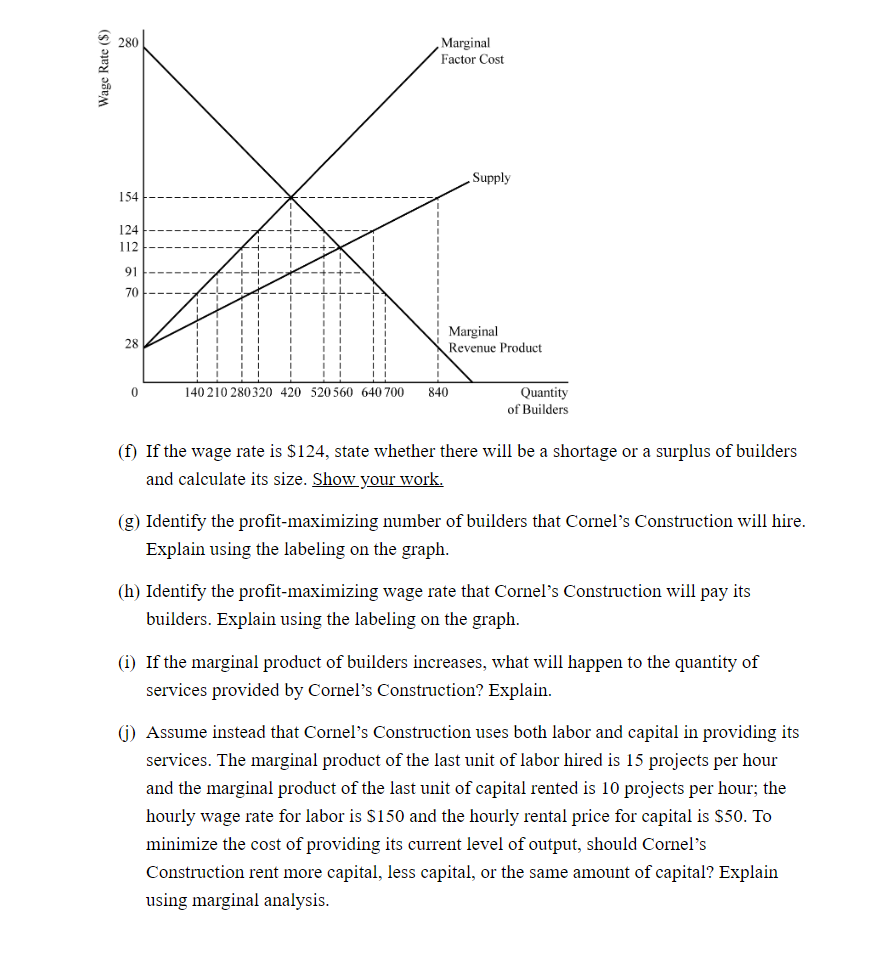

Marginal Revenue and Marginal Cost for a Monopolist

0 kommentar(er)

0 kommentar(er)